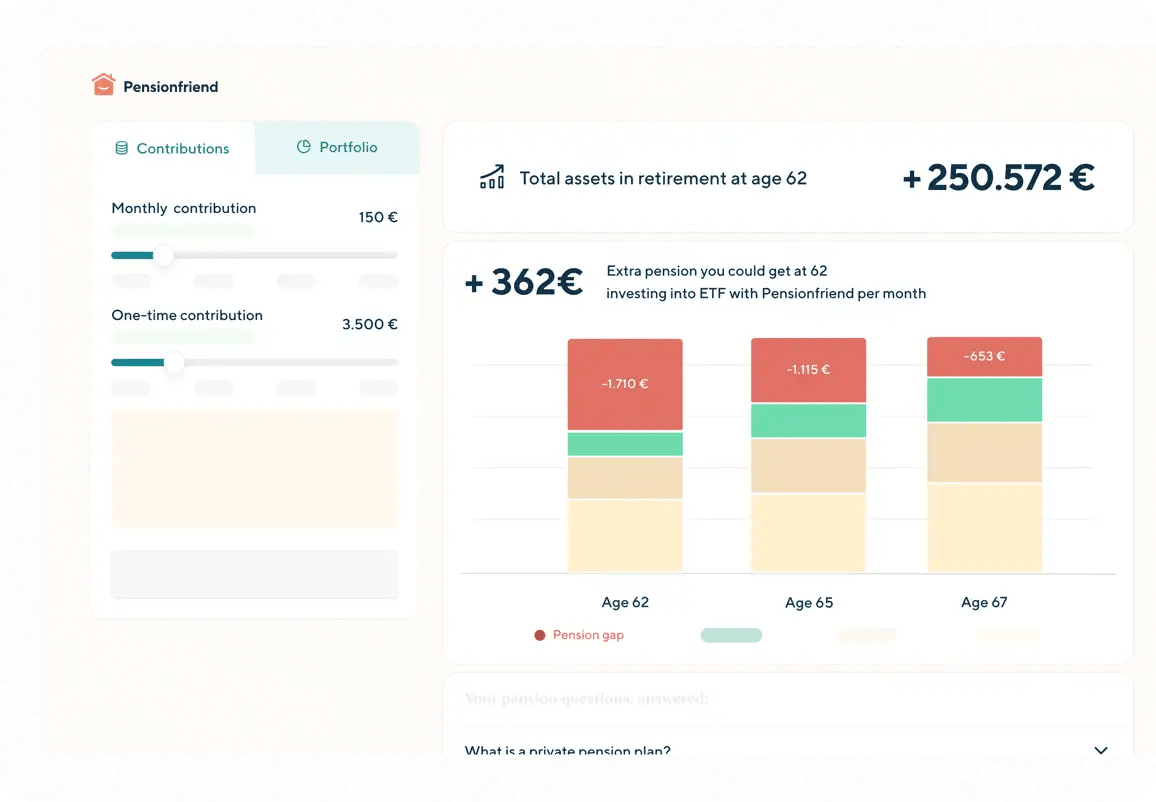

Contribute from as little as 100 € / mo.

Hand-picked portfolios from 500+ ETFs

Benefit from tax-free compounding

Digital, low-cost solution for worldwide retirement

Why do you need a Private Pension Plan?

Public pensions in Germany often fall short of providing a comfortable retirement. Self-managed investments through brokers frequently yield poor returns and lack tax benefits.

Meet Pensionfriend: your retirement solution

We help you invest and retire safe and sound with our low-cost, high-performance pension plan.

Who is Pensionfriend for?

We recommend you the optimal composition of our outperforming portfolios. You benefit from tax-free, automatic rebalancing so you can retire with more!

Our three ETF-based pension products

We’ve created three investment portfolios, based on our detailed analysis of the longest data series available. It dynamically adapts based on your income, age and portfolio performance. i

Global

Global large and small capitalization companies that historically outperform the MSCI World Index.

- Currency

- USD

- ETF cost per year

- 0,25 %

- Pensionfriend cost per year

- 0,49 - 0,69 %

- Expected annual return

- 8,30 %

- Average historic performance

- 12,96 %

- 2023 performance result

- 20,77 %

- 2024 performance result

- 25,76 %

- 2025 performance result

- 14,01 %

- Expected net assets at age 67*

- 468.117 €

Global Green

Large and small capitalization companies, fulfilling environmental, social and governance (ESG) criteria.

- Currency

- USD

- ETF cost per year

- 0,28 %

- Pensionfriend cost per year

- 0,49 - 0,69 %

- Expected annual return

- 7,90 %-8,20 %

- Average historic performance

- 14,20 %

- 2023 performance result

- 21,57 %

- 2024 performance result

- 24,81 %

- 2025 performance result

- 14,30 %

- Expected net assets at age 67*

- 432.735 €

Euro Green

European large and small capitalization companies, fulfilling environmental, social and governance (ESG) criteria.

- Currency

- EUR

- ETF cost per year

- 0,26 %

- Pensionfriend cost per year

- 0,49 - 0,69 %

- Expected annual return

- 7,20 %

- Average historic performance

- 8,01 %

- 2023 performance result

- 18,33 %

- 2024 performance result

- 12,28 %

- 2025 performance result

- 16,05 %

- Expected net assets at age 67*

- 330.912 €

«We expect to perform 2% better than the MSCI World Index»

Dr. Chris Mulder. Former IMF and World Bank Manager, who advised Public Officials managing trillions of euros in assets.

Pensionfriend Portfolio Performance in 2024

+ 25,76 %

Global

+ 24,81 %

Global Green

+ 12,28 %

Euro Green

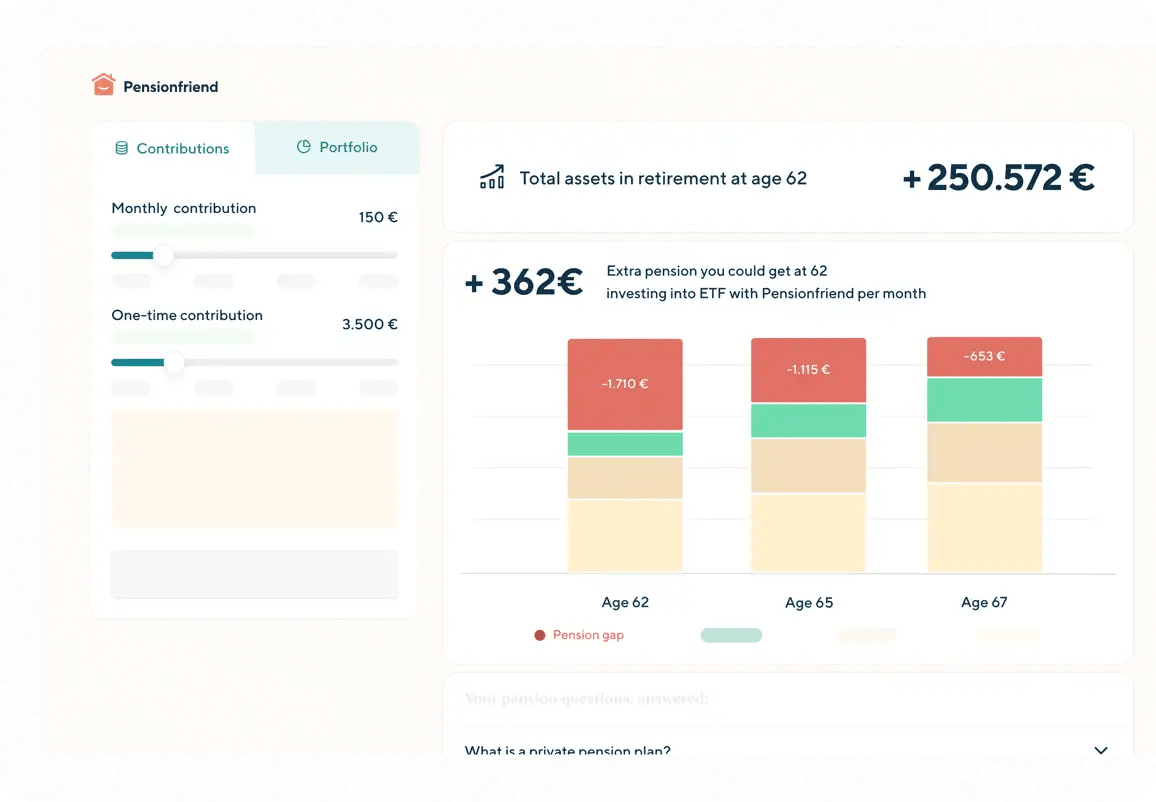

How does Pensionfriend compare?

Understand how Pensionfriend compares to investing in ETFs directly or how it compares to a more classic private pension product with upfront fees.

Our pricing is transparent and fair

We’re confident in our performance. That’s why we don’t charge any upfront, withdrawal, or cancellations fees unlike almost every other broker in Germany. Also, when your assets grow, we charge you less over all of your pension savings.

0,69

per year

for all pension savings under 250.000 €

0,49

per year

from 250.000 € in pension savings onwards

No cancellation fees

iNo rebalancing costs

iNo upfront fees

iNo withdrawal fees

i