We build optimal ETF portfolios to help you createa a financially secure future.

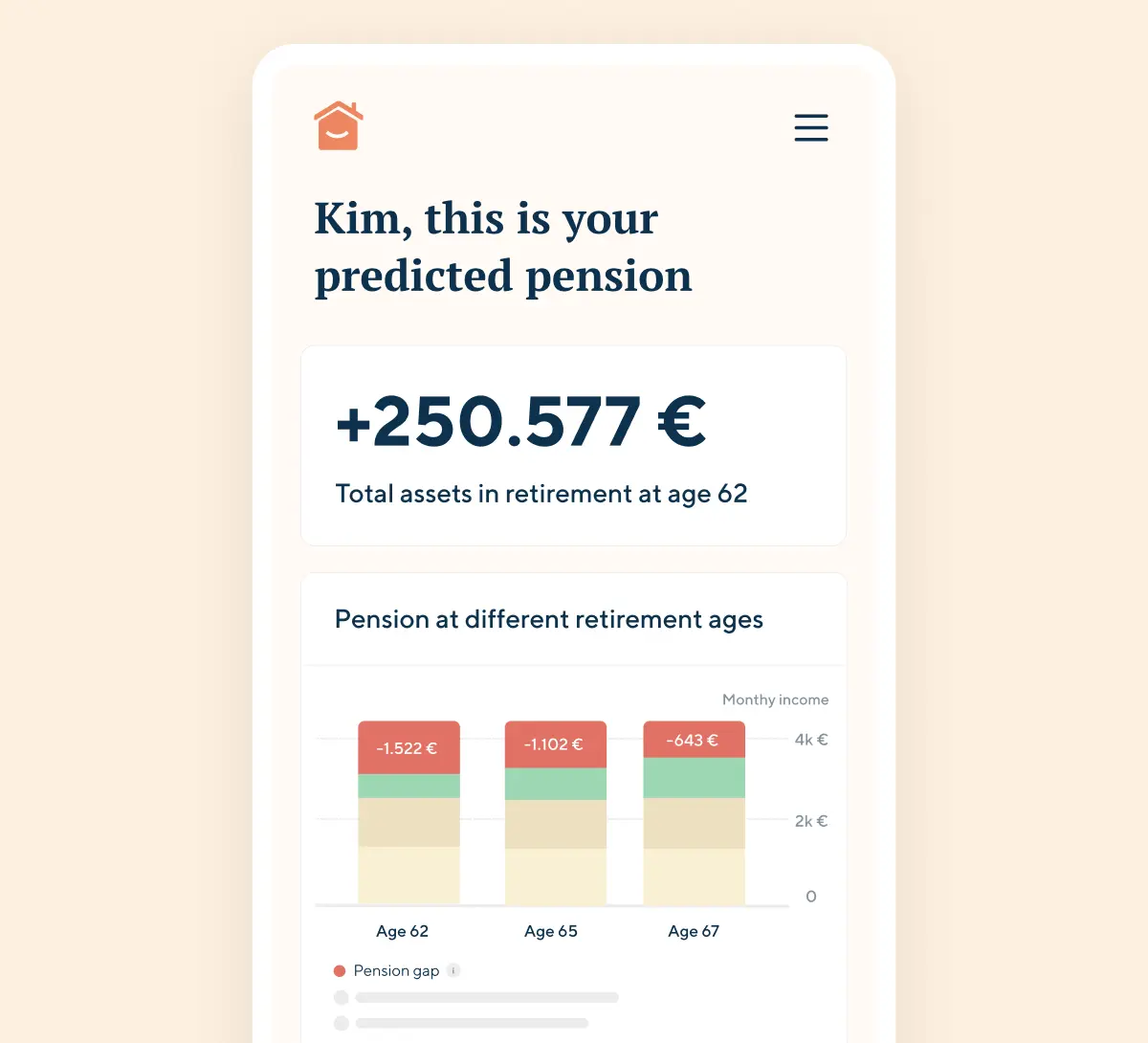

Easily calculate your pension gap

Just answer a few questions to see how much you need to save and when you can retire.

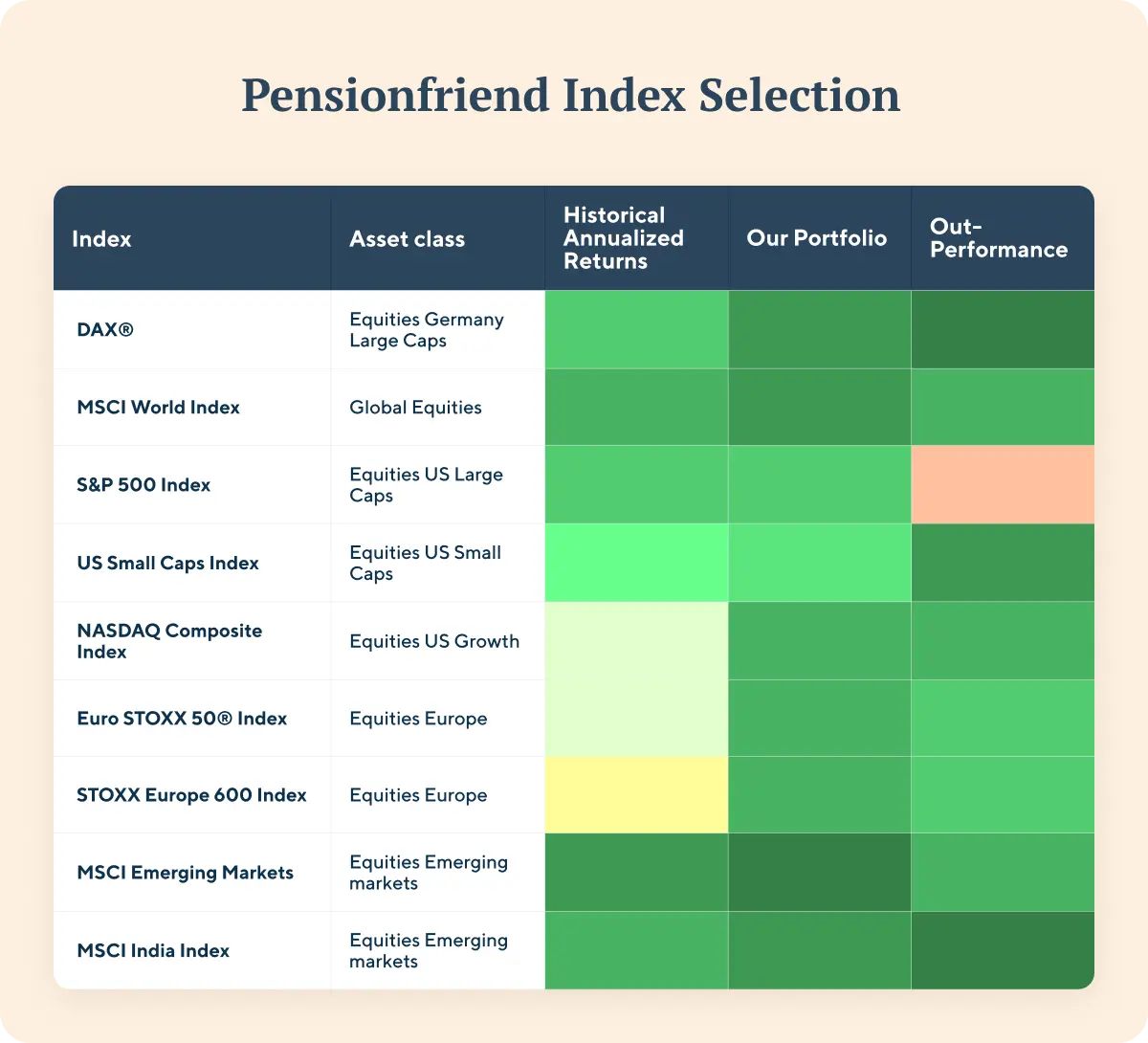

We'll help you design your optimal ETF portfolio

We constantly compare hundreds of indexes and ETFs to find you the best options leveraging decades of experience in finance.

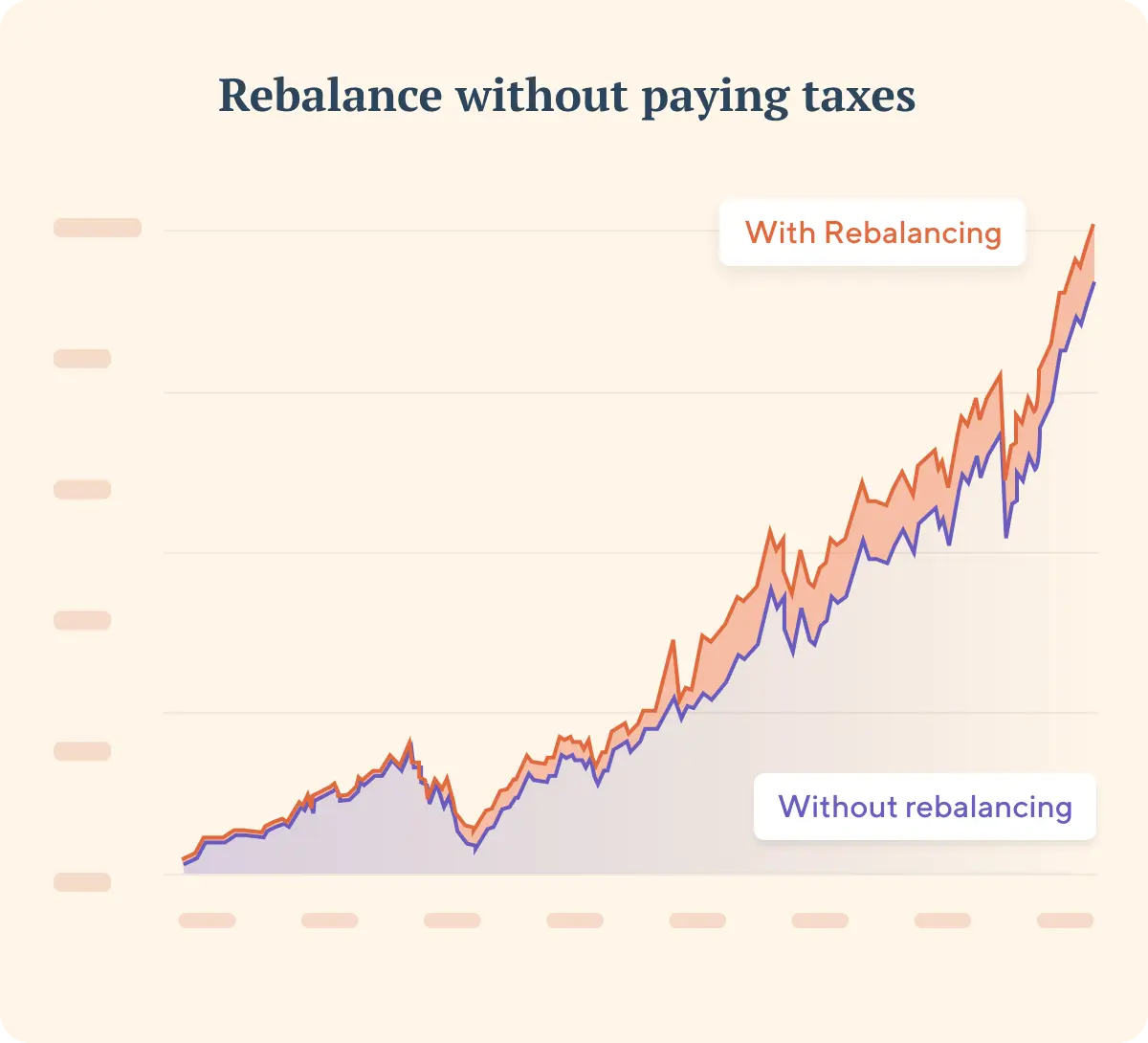

Maximize ETF returns with a tax-shield

Buy and sell ETFs within our tax-shield any time. We help your portfolio evolve as your life – and the world – changes, without you being punished with tax every time you adjust.

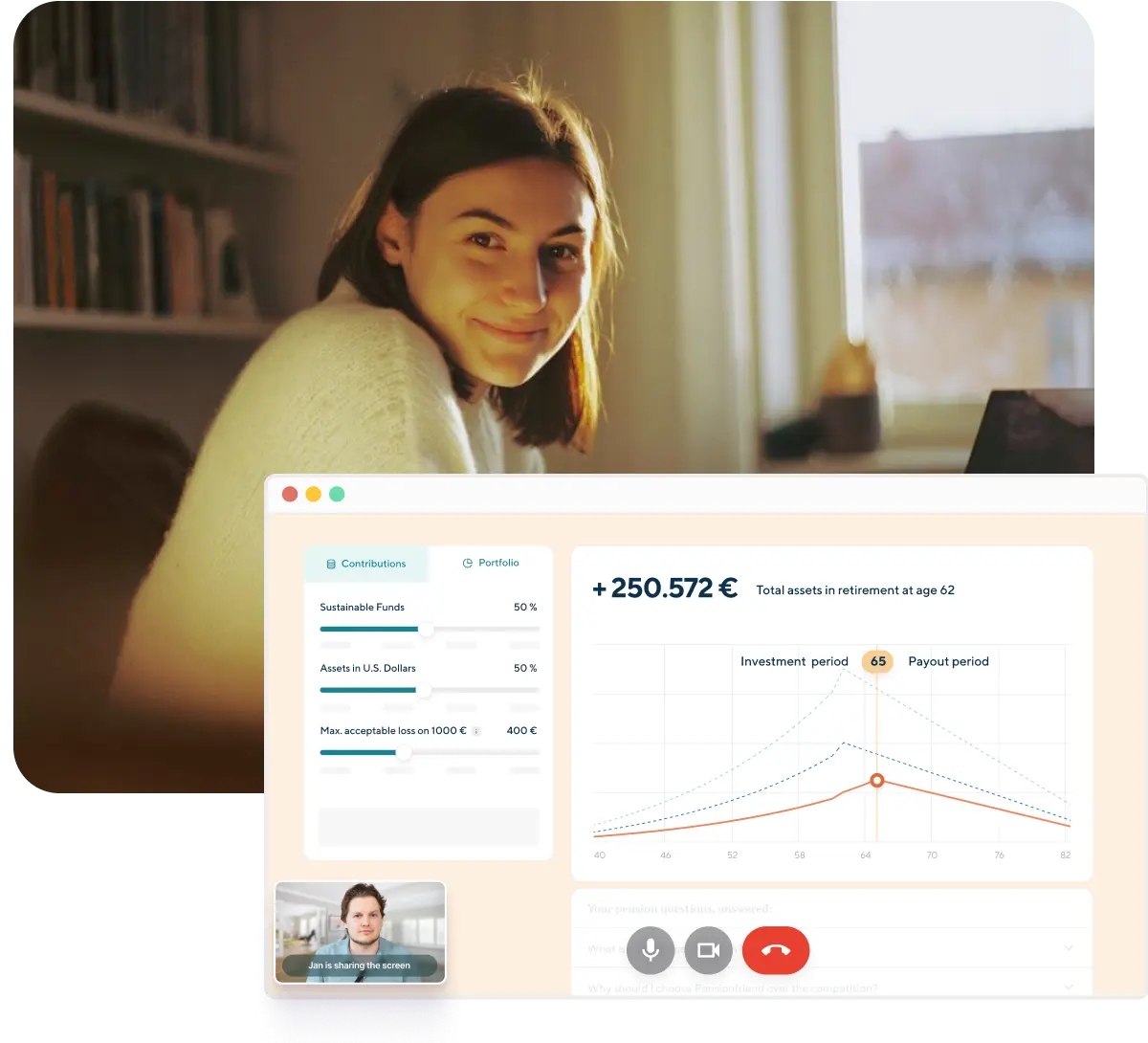

Financial planning over video for free

Our advisors will guide you through your options online helping you to understand the best ETFs for you. Our job isn't done until you're happily retired.

Your money is safe and accessible

Your savings are securely insured with our partner, Liechtenstein Life AG – and always at your fingertips in the Pensionfriend app, whether you stay in Germany or move abroad. Even better: your money is shielded from Exit Tax regulations.

Keep more of your investment returns

Keep the annual withholding tax for yourself and save on capital gains taxes, worth around 1–1.5% per year. On top of that, our ETF selection and automatic rebalancing can add up to ~2% extra return. We keep our fees low so that you'll be better off by roughly 2% per year over the long term.

0,69

per year

for all pension savings under 250.000 €

0,49

per year

from 250.000 € in pension savings onwards

No cancellation fees

iNo rebalancing costs

iNo upfront fees

iNo withdrawal fees

i«We've outperformed MSCI World Index by +20%»

Dr. Chris Mulder. Former IMF and World Bank Manager, who advised Public Officials managing trillions of euros in assets.

Pensionfriend Portfolio Performance since inception

+ 20,77 %

2023

+ 21,57 %

2024

+ 18,33 %

2025