How do Pensionfriend's Plans Perform?

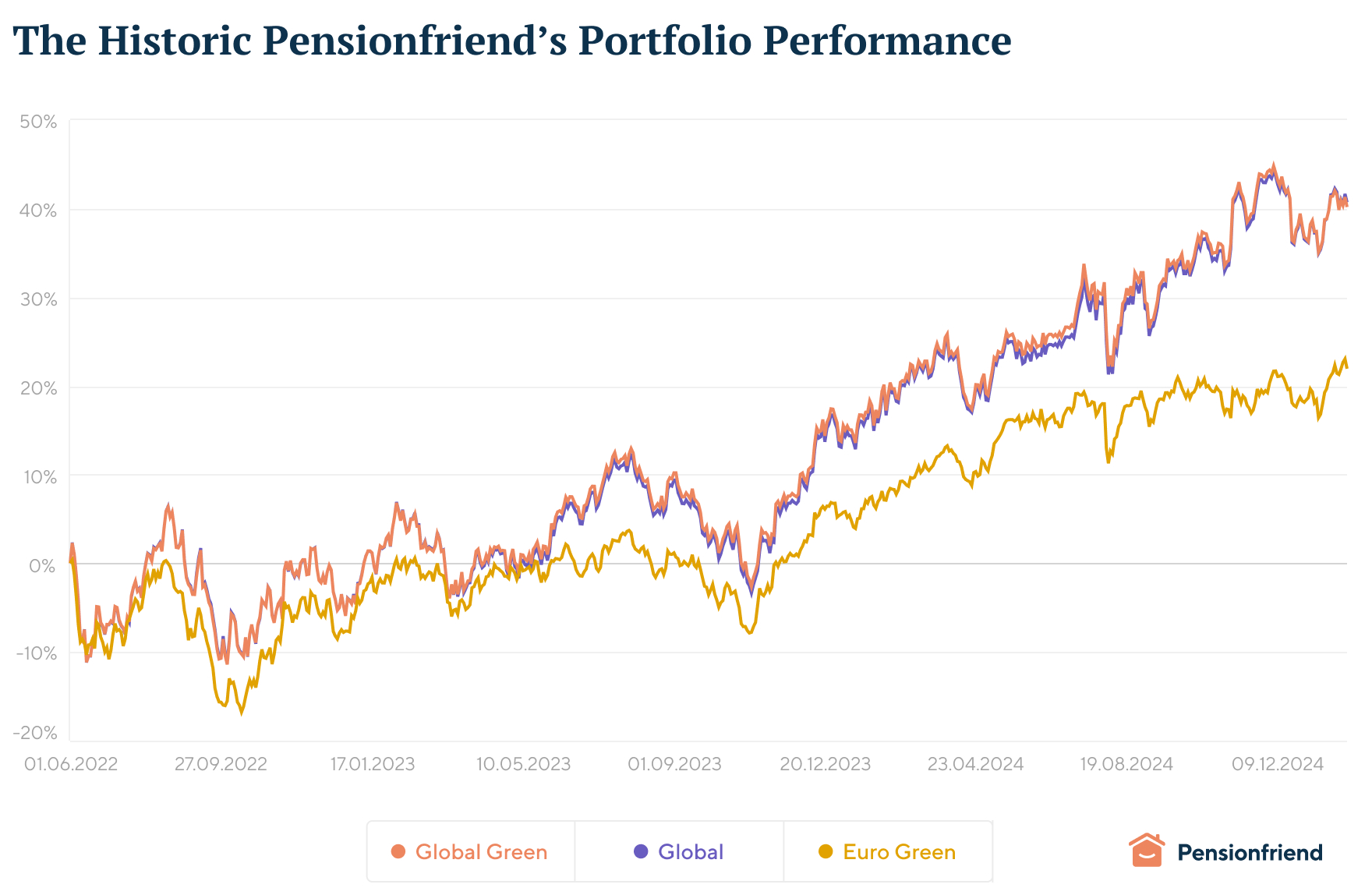

What is Pensionfriend’s actual performance? Below you see our portfolios since we onboarded our first customers in July 2022.Updated on 12 November 2025

Updated on 12 November 2025

Global, Global Green, and Euro Green—each serves a distinct purpose:

The Global Portfolio aims for the highest expected long-term return, prioritizing broad market exposure.

The Global Green Portfolio follows a similar strategy but excludes more non-ESG investments, aligning with sustainable investment principles.

The Euro Green Portfolio seeks strong performance while focusing on Euro-denominated assets to minimize currency risk, all while maintaining the lowest possible cost in terms of net return.

This structured approach allows investors to choose a portfolio that best aligns with their financial goals and risk preferences

YoY performance is a window into our philosophy:

Tax Efficiency: Our “tax wrapper” shields rebalancing gains and allows tax-free compounding. Withdraw after 62, and only half your returns are taxed.

Sustainability: The Global Green portfolio’s +24,81 % YoY growth in 2024 proves responsible investing can deliver strong returns.

Flexibility: Adjust contributions anytime, retire anywhere, and even add beneficiaries—like your children—to your plan.

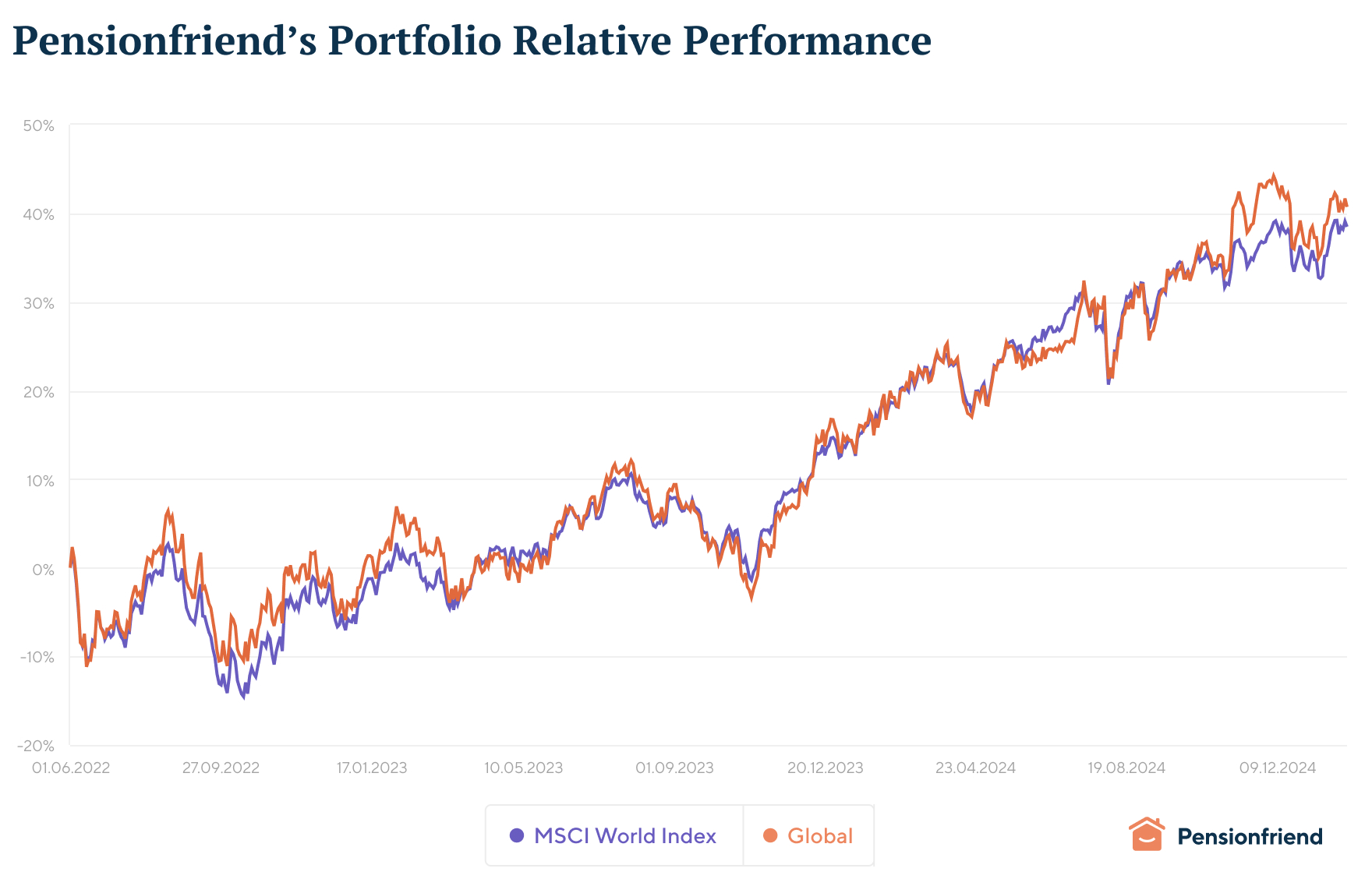

Global | Global Green | Euro Green | MSCI World index | |

|---|---|---|---|---|

Annual Return in EUR | 16,63 % | 16,44 % | 8,30 % | 16,06 % |

Our performance isn’t just a number—it’s the heartbeat of your retirement strategy. But you need to keep in mind that sometimes it is running high and sometimes the heartbeat is slow. The key is achieving reliable long-term compounded growth. We aim for about 8% for the global portfolio, exceeding the expected performance of the MSCI world by 2%.

We openly publish our performance metrics because we believe in accountability and trust—transparency is a core value.

Each year, we provide our customers with a detailed annual report covering portfolio performance and a market overview. Explore our latest reports:

Our "tax shield" protects your investments in two powerful ways. First, we can rebalance your portfolio without you incurring taxes. Second, your returns compound tax-free until withdrawal—unlike broker-held ETFs that incur annual taxation. After age 62, only half of your returns are taxed. Additionally, if you name family members as beneficiaries, they'll receive your investment completely free of capital gains tax should you pass away before the policy ends.

Our private pension plan returns are not limited by the restrictions imposed on investments such as company pension plans or limited in terms of payout to costly annuities like Rurup plans. The tax shield of a private pension plan works especially well for high return ETFs as you pay tax only once, when you take the money out.

Adjust contributions anytime, retire or move abroad, and even add beneficiaries—like your children—to your plan. You can tailor your payout, in the form of lump sums or even an annuity later in life. You can stay invested until age 85, extending your tax-free compounding for decades.

At Pensionfriend, performance isn’t just a calculation assumption of 0, 3, 6 or 9% returns like virtually insurance company plans, or a gamble like many other investments. We’ve designed our portfolios to outperform in the long-run while keeping costs among the lowest in Germany. Whether you’re an expat planning to retire abroad or a local saver seeking stability, our data-driven approach ensures your pension grows in the long-term.

Ready to See Your Progress?

📊 Calculate your savings needs and wealth potential with our Pension Dashboard.

📅 Join our free webinar to learn how we outperform traditional pensions.

💡 Learn more Pensionfriend or discover interactive articles and calculators.

⭐️ Book an appointment with our pension expert to discuss your situation.