The Cost of Pensionfriend’s Pension Plan Explained

We explain our simple asset-based fee and why upfront, exit, and hidden costs can harm your pension savings.Updated on 13 November 2025

Updated on 13 November 2025

There are only three essential factors that determine the return on your investment:

With Pensionfriend's Global Outperformance portfolio, the next expected return is 6,7 %. It consists of an expected return of about 8,30 %, costs you pay of 0,49 % — 0,69 %, and an estimated effective tax rate of 0,48 %. The tax rate is calculated for a 35-year-old holding the portfolio until 65. The performance of 8,30 % includes both the cost of the ETF (an average of 0,25 %) and their expected outperformance compared to the index. This is referred to as the “tracking difference” and is a key measure for assessing the cost of ETFs that track indices.

We want to keep costs as simple and transparent as possible: We only charge 0,69 % of assets under management per year. For portfolios over 250.000 €, the overall fee declines to 0,49 %. No hidden fees, no closing costs, and not even a cancellation fee if you would rather not continue your pension plan. The only exception is when your total contributions are below 10.000 €; our insurance partner holds a 7,50 € administration fee per month. This fee, however, is invested into a high-yielding loyalty fund, which you will have access to at retirement age.

Secure your retirement with Pensionfriend's flexible and tax-efficient pension plan

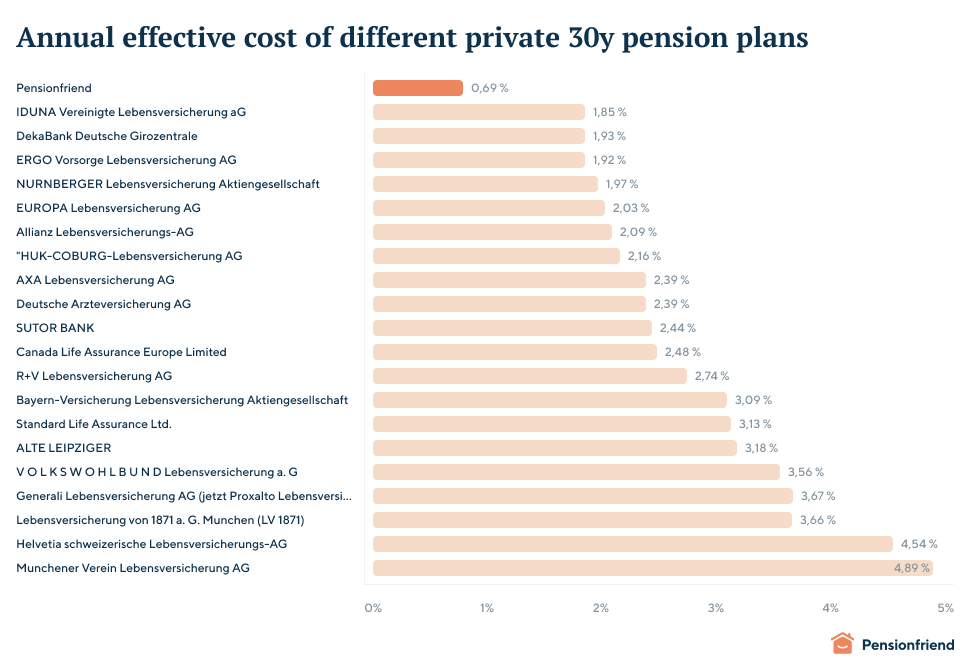

When building Pensionfriend, our approach to pricing was to reduce the cost to well under 1 % so that we could directly compete with ETFs given the tax benefits of our tax shield.

Pensionfriend is the lowest-cost product with an app to track your assets, along with the additional benefits of a tax shield and life insurance. Additionally, we add small performance wins to offset the costs. ETFs that outperform their index, reliably and rebalancing approaches that can add a marginal return (0,10–0,15 %) instead of adding trading costs. Finally, you benefit from our fund selection, which is built on decades of experience.

By keeping costs as low as possible, we create a return on investment that is as high as possible.

Upfront fees are especially damaging, which is why we don't charge them.

There are two main reasons why upfront fees can cost you so much.

Firstly, if you decide to cancel your policy, the cost of the upfront fees becomes a much higher percentage of your contributions. Let's take an example: a 27-year-old individual who pays 2,5 % of their lifetime contributions as an entry fee effectively pays the equivalent of a full year's contributions (2,5 % of 40 years). If this person decides to terminate the plan after 5 years, the cost of the upfront fees would be a staggering 20 % of their total contributions.

Second, upfront fees have a greater impact because the money paid upfront would have had the longest time to work for you to generate returns. Paying fees later in your investment journey is generally more advantageous than paying them upfront. For example, with our global portfolio, the 2.500 € upfront fees a 27-year-old would pay elsewhere will grow to a staggering 34.022 € (after our cost) when he/she turns 67!

Others may charge such upfront fees as they have no confidence in their product, so they must cover their costs early. After all, you might leave after you find out all the details.

With Pensionfriend, our interests are aligned. We are confident that our products are among the best and that you will be satisfied that our products offer you a great opportunity for a secure pension.

Exit fees and acceleration fees can be nasty, which is why we don't charge them.

Our approach is simple: we charge no exit or acceleration fees. In this way, our interests are fully aligned with the customer: delivering a high return at a low cost, which reduces your incentive to leave your pension plan early.

Exit or acceleration fees also keep customers in a program despite poor returns. They are often harder to assess. They are mentioned but not quantified. For example, if you take your money out, you will surrender part of your return, or if you stop contributing, you will be charged an additional annual fee, the impact of which is difficult to estimate. These fees are designed to discourage customers from leaving even if the plan is underperforming.

Fund fees can worsen it, but we aim for low cost offset by reliable performance.

Many investment products also have additional upfront fees or high management fees. You may get tempted to buy these products as they have a “special” high performance. In our contention, these products rarely show sustained outperformance. Their historical outperformance is an anomaly and does not guarantee future performance. As we argue in our performance article, there are only a few sources of outperformance that are persistent. Some people can outperform — but there is a whole industry to find (and reward) those people, and this usually results in their salaries offsetting their potential outperformance.

Indeed, the costs associated with active management or smaller funds are rarely justified. It is widely recognized in the industry that active management does not consistently deliver better performance but rather adds to the cost.

At Pensionfriend, we have taken a different approach. We focus on indices that are most likely to outperform for fundamental reasons. To invest in these indices, we don't select actively managed funds or ETFs, but ETFs that are low cost and have a record of systematically outperforming the index.

ETFs can systematically outperform the index by implementing intelligent management strategies, such as securities lending and anticipation of index changes or using sampling techniques that avoid buying all the stocks in the index. These strategies add a small but systematic value to the performance of the ETFs. It's important to note that this approach is not active management but rather smart management, using tactics that enhance returns without incurring excessive costs.

By adopting this approach, we aim to provide our clients with the best possible performance while controlling costs. We prioritize selecting ETFs with strong track records and using strategies that optimize returns. This ensures our clients can benefit from potential upside while maintaining a cost-effective pension plan.

Effective costs, known as “Effektivkosten” in German, provide a comprehensive measure for comparing the costs of different pension products. Four important notes here:

These “Effektivkosten” don't cover hidden costs of fund management.

The costs depend very much on the period held. So with upfront costs, the effective costs are much higher if you hold it a short period. Furthermore, with a low return, these upfront costs lead to much higher “Effektivkosten”.

Additional costs of up to 9,5 % with certain insurers for adding one-time contributions into your contract aren’t calculated into the effective costs. However, these immense costs will have a great impact on overall costs. The same applies to additional upfront costs, which are added in case you increase your monthly contributions.

Cost shouldn't be the only consideration. Performance must also be considered. If higher costs lead to better performance, the costs may be justified.

Our key ETF costs are remarkably low for large capitalization stocks (0,07 %), representing valuable companies with high trading volumes. These low costs are achieved through economies of scale. Costs are higher for small-cap stocks as the volumes are smaller, but these have a rather strong proven track record of outperformance, and their extra short-term volatility should not worry long-term investors. However, we aim to offset these costs through outperformance.

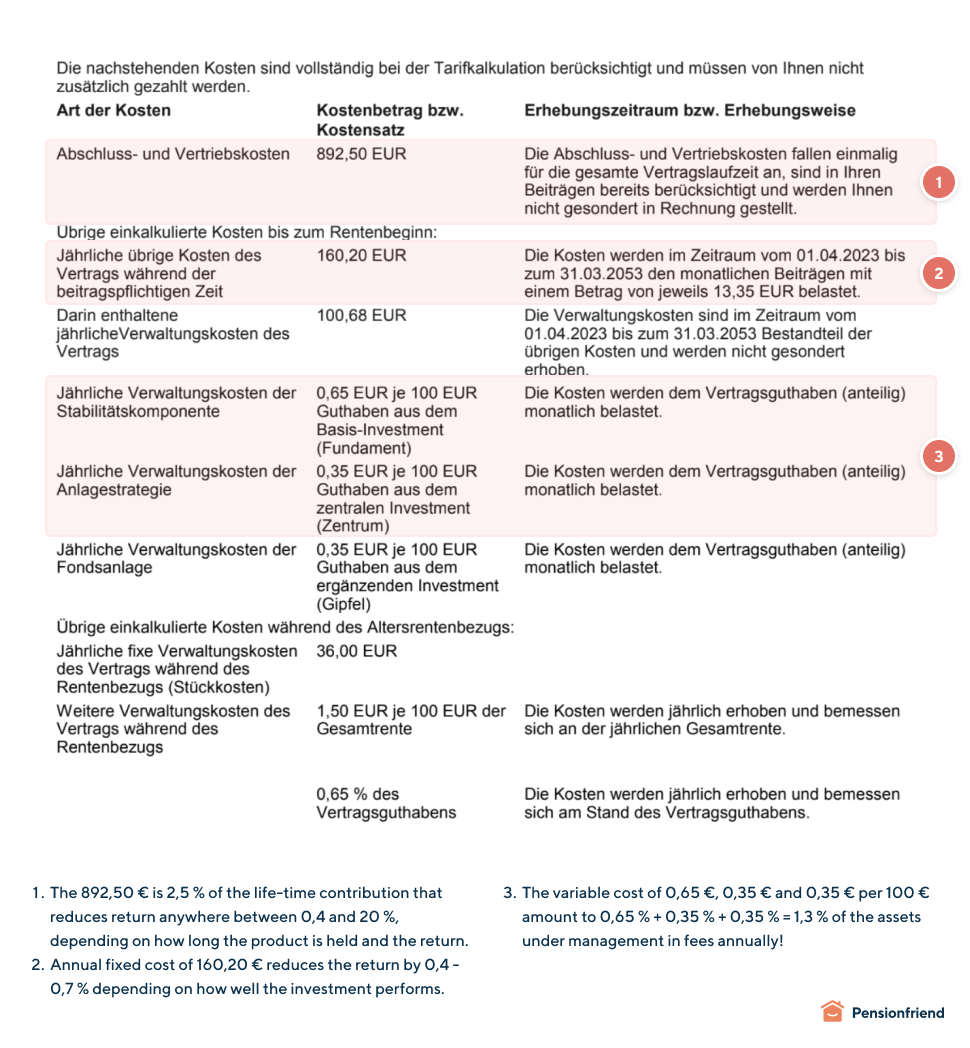

Example. You often find the following information somewhere on your product:

This means that even if you hold the product until the end date and ignore any hidden fund management fees, the cost is already 1,68 %.

Upfront and distribution costs (“Abschluss- und Vertriebskosten” in German): These costs include the commissions paid by the insurance company to insurance agents. The commission is calculated as a percentage of the premium. Currently, insurers can include up to 2,5 % of the premium amount as a balance sheet item. Any excess, typically up to a maximum of 4 % (2,5 % + 1,5 %), must be financed from profits. This limit applies from 2015. In the first 5 to 7 years, the total start-up and distribution costs are offset against contributions, a process known as “Zillmerung” or “Zillmer-Verfahren.”

Running administration costs (“Laufende Verwaltungskosten” in German): Each insurer charges a fee for managing the contract out of the premiums. In 2021, the average administrative cost ratio for all insurers was 2,1 %.

Investment costs (“Anlagekosten” in German): Investment costs are deducted from the policy balance and depend on the amount invested and how the money is invested. Typically, these costs are deducted, usually as a fixed percentage of the policy value. For example, 0,5 % per 100 € of the contract value per year. These costs form part of the administrative costs.

Unit costs (“Stückkosten” in German): Unit costs refer to a monthly flat fee charged per contract, which is deducted from monthly contributions. Unit costs can have a disproportionate and underestimated impact, particularly on policies with low contributions.

Fund company costs (“Kosten der Fondsgesellschaften” in German): When part of the contributions are invested in funds, the fund companies charge a fee based on the contribution amount. Fees are often between 1 and 2 %. Opting for low-cost ETF investments (index-tracking funds) is generally preferable, as ETFs have an average cost of around 0,4 %. Be especially careful with investments in funds run by the same company. They not only tend to underperform the ETF but also charge additional costs. This is, unfortunately, quite a shocking common practice.

“Abschluss- & Vertriebskosten” plus administration costs are also due if you add one-time payments to your contract. Many insurers charge 6 %, some up to even 9,5 % of that additional contribution.

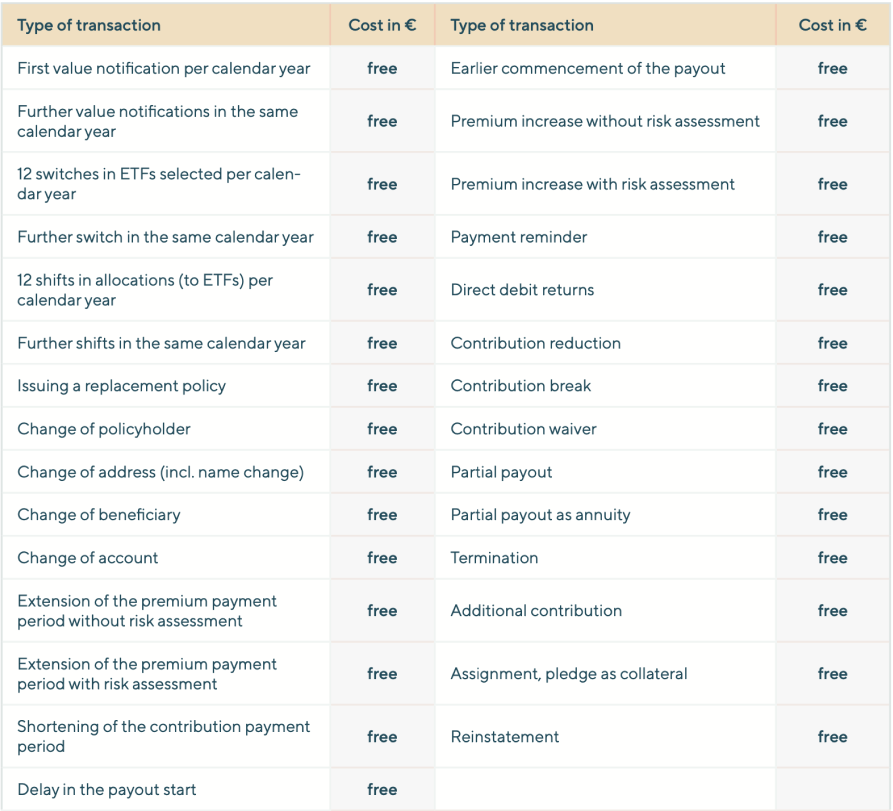

Pensionfriend charges no fees for all standard business transactions initiated by you